Long Term Capital Gains Tax Rate 2024 Married

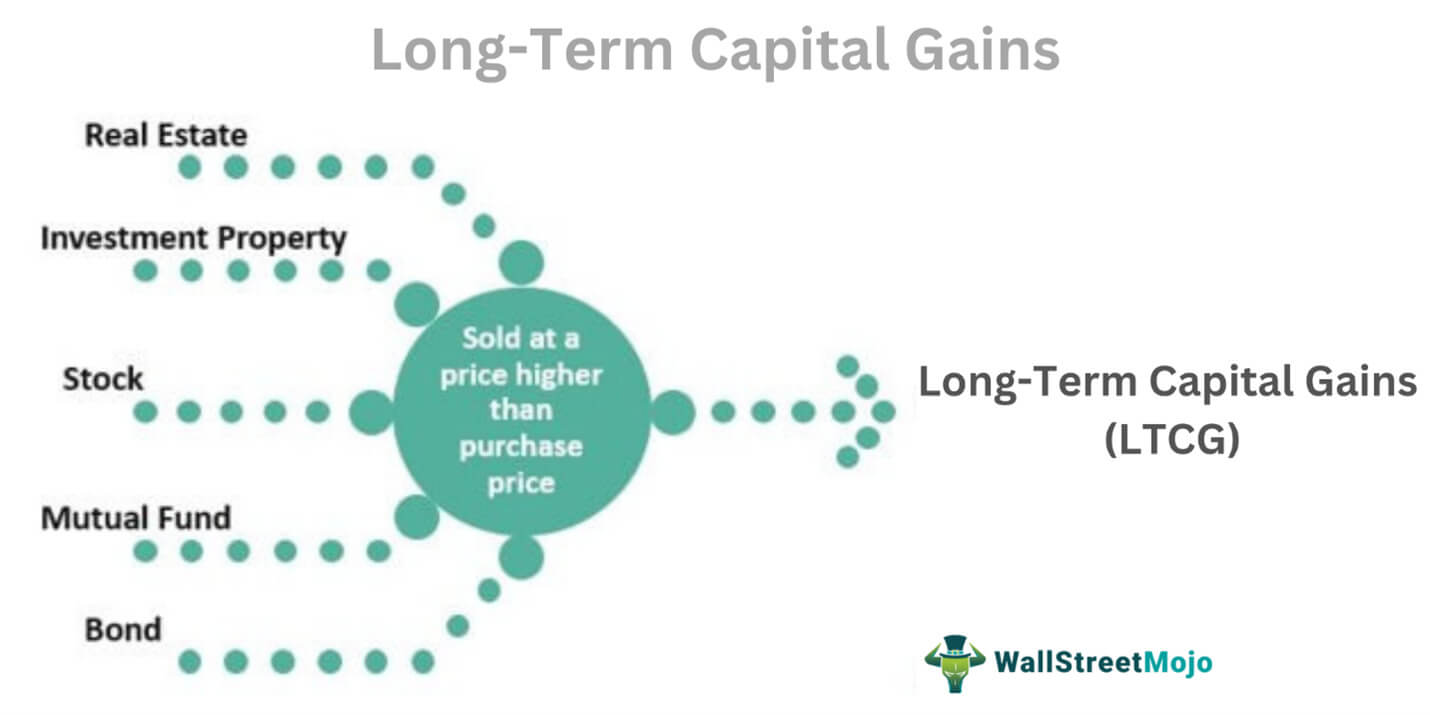

Long Term Capital Gains Tax Rate 2024 Married. However, it removes the indexation benefit. What is long term capital gains tax or ltcg tax?

The higher your income, the more you will have to pay in capital gains. Based on filing status and taxable.

Long Term Capital Gains Tax Rate 2024 Married Monah Mathilda, Single tax filers can benefit. High income earners may be subject to an additional 3.8% tax called the net investment income tax on both.

LongTerm Capital Gains Tax Rate 2024 Grayce Charmine, Based on filing status and taxable. The higher your income, the more you will have to pay in capital gains.

Capital Gains Tax Rate 2024 Overview and Calculation, Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns. Single tax filers can benefit.

Tax On Long Term Capital Gains 2024 Gail Paulie, What is long term capital gains tax or ltcg tax? High income earners may be subject to an additional 3.8% tax called the net investment income tax on both.

2024 Long Term Capital Gains Tax Calculator Chris Delcine, The amount you’ll pay depends on your taxable. Which one you use to calculate capital gains taxes depends on.

LongTerm Capital Gains Tax Rate 2024 Chart Sonni Cinnamon, The union budget 2024 has. Single tax filers can benefit.

ShortTerm And LongTerm Capital Gains Tax Rates By, Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a specific period. The union budget 2024 has.

Long Term Capital Gains Tax Rates 2024 Gerti Juliane, What is long term capital gains tax or ltcg tax? Exemptions and deductions, like the annual rs.

Capital Gains Tax Rates 2024/5 Tilda Gilberta, The amount you’ll pay depends on your taxable. The higher your income, the more you will have to pay in capital gains.

Long Term Capital Gains Tax Rate 2024 Trusts Dulce Glenine, Remember, this isn't for the tax return you file in 2024, but rather, any gains you incur. Single tax filers can benefit.

High income earners may be subject to an additional 3.8% tax called the net investment income tax on both.